Q3 2023 Colony Market Perspectives

Introduction

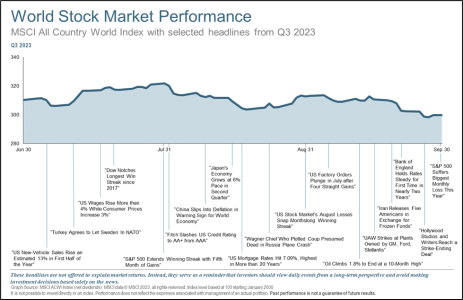

Equity markets declined during the third quarter following a surprisingly strong first half of the year. Investors had started to warm to the idea that the Federal Reserve (Fed) was successfully guiding the U.S. economy towards a soft landing, which would ultimately allow the Fed to ease monetary policy. Nevertheless, a modestly hotter than expected inflation report and revisions to the Fed’s dot plot (the FOMC’s participants’ projection for interest rates) scared investors into believing that interest rates will remain higher for longer.

The S&P 500 returned -3.3% for the quarter, but thanks to the strong start to the year, it remains up +13.1% year-to-date. August and September lived up to their reputation as some of the worst returning months of the year, declining -1.8% and -4.9%, respectively. Energy stocks were the lone sector to produce positive returns during the quarter, rising 12.2%, on the back of a 28.5% jump in the price of oil. International stocks underperformed domestic stocks largely due to the stronger dollar.

The Fed remains careful not to relent too soon in its battle against inflation, and its unwavering hawkish rhetoric caused an increase in volatility in the bond markets. The 10-year Treasury yield rose to its highest level since 2007 during the quarter, causing broad losses across most fixed-income sectors. The Bloomberg US Aggregate Bond Index, the broadest bond index, returned -3.2%, its second consecutive down quarter. Treasuries, municipals, and corporate bonds all declined by more than 3%.

Novice investors quickly realize how difficult it is to predict the economy and markets. Most investment professionals also experience a heavy dose of humility at some point in their careers. The post-pandemic environment is proving even more difficult to discern than normal. Indeed, investors came into 2023 expecting inflation to decelerate as the Fed’s tightening campaign pushed the economy into a recession.

As of today, we have yet to see the economy slow materially and inflation remains high relative to the past couple of decades. In the remainder of this letter, we will look more closely at what the pundits missed and how the Fed may react.

What Happened to the 2023 Recession?

Coming into this year, many prognosticators were forecasting a recession for the U.S. economy. Stocks were down big last year, which was thought to herald a first-half recession. Other economic indicators, such as the inverted yield curve, a declining U.S. leading economic indicator (LEI), weakening purchasing manager surveys, and negative earnings growth supported the pundits’ thesis. Here we are more than three quarters of the way through the year, however, and still no recession. What did many of these supposed experts miss?

One factor that has kept the economy stronger than expected is consumer spending. Many economists felt that rising interest rates, a falloff in the wealth effect caused by poor investment returns and slowing home prices, and diminishing pent-up demand would cause consumption to slow. They underestimated the magnitude of excess savings on consumer balance sheets coming into the year. The largesse from pandemic-related fiscal spending placed an estimated incremental $2 trillion of excess savings in consumers bank accounts, supporting above-trend spending. In addition, the job market remains surprisingly strong and is helping consumption stay robust.

Another factor the experts missed was the surge in federal spending. The fiscal deficit, which is the best way to measure fiscal stimulus, increased by $943 billion or 3.4% of GDP during the current fiscal year according to Alpine Macro. This pace of growth for net government spending is unusual during an economic expansion. There were several reasons for this increase. To begin, stock market losses in 2022 caused lower capital gains tax payments this year. In addition, there was an unusually high increase in the social security cost of living adjustment (COLA) due to high inflation. Another significant contributor was President Biden’s temporary cancellation of student debt, which was ultimately invalidated by the Supreme Court. These tailwinds are expected to subside in 2024.

Economic forecasts are about as reliable as long-term weather forecasts or political polling so we should not be surprised that predictions for 2023 were so far off. This highlights the difficulty in investing using near-term economic forecasts. There are too many factors that influence both the economy and markets for any individual to have enough expertise to get all of it right consistently.

What this means? – Recessions are inevitable. Therefore, it is not a question of if, but rather when the next one occurs. Moreover, the longer an economic expansion lasts the more conviction people have that it will soon end. As such, we expect that, once again, many economists will project a recession in 2024.

The economy continues to exhibit solid momentum. The strength of the dollar and the recent increase in bond yields are generally associated with an economic expansion. On the other hand, tightening financial conditions, weaker growth outside the U.S., and fiscal tightening next year could force a contraction in economic activity. The reaction from policymakers will likely be the ultimate arbiter of whether the expansion continues or gives way to a recession. Investors must remain alert to any signals that the regime is changing. Directing investments exclusively around one outcome is not a winning strategy. It is why we emphasize diversification as a foundational component of our investment philosophy.

Higher for Longer

At its recent meeting, the Federal Open Market Committee (FOMC) implied that the Fed might keep interest rates higher for longer. Fearful that inflation may rekindle and mindful of the mistakes made by previous Fed Chair Arthur Burns, Powell seems to be going out of his way to emphasize the Fed’s resolve.

Recent economic reports show that Inflation is on the decline. Nevertheless, there are reasons for the Fed to remain vigilant. Core inflation, which excludes the volatile food and energy components, remains high relative to history. While this is likely the result of lags in the calculation of the shelter component of inflation, it remains a focus of the Fed. In addition, the recent spike in the price of oil runs the risk of pushing inflation higher. Indeed, the price of West Texas Intermediate oil is up more than 36% since its March 2023 lows having recently breached $90 per barrel. Lastly, high profile labor disputes by the Teamsters, Writers Guild of America, and United Auto Workers unions, to name a few, indicate that there may be continued upward pressure on wages. There have been 56 strikes in the first nine months of this year, according to the Cornell University School of Industrial and Labor Relations, a 65% jump from 2022.

The Fed has communicated their intent to leave rates higher for longer. At its September meeting, both their summary of economic projections and the dot plot demonstrated their enduring concerns. Indeed, the median plot for 2024 policy rates projected a smaller cut in rates than the previous survey, tempering investors’ conviction that the committee will cut rates next year. That this occurred even though their forecast for inflation was unchanged has investors spooked. Historically, higher unemployment has been a reason for the Fed to cut interest rates.

These factors partially explain the recent spike in longer-term interest rates. The yield on the benchmark 10-year U.S. Treasury has climbed by nearly 100 basis points since the end of July and is rapidly approaching 5%, a level not seen since the fall of 2007.

Fortunately, higher rates have not yet had a material impact on economic growth. Unfortunately, it is likely only a matter of time before they do. It is widely known that interest rate policy works with long and variable lags. Typically, growth slows and employment softens between 12 and 24 months after the first interest rate hike, which in this cycle occurred in March 2022. Since we are still within this window, it is logical to assume that growth may decelerate. In fact, the aggressive borrowing at historically low interest rates during 2020 and 2021 suggests that this cycle’s lag might be longer than usual.

What this means? – Holding interest rates higher for longer has a multitude of effects on investment markets. The post-financial-crisis era has been called by some the period of financial repression, inflicted on investors by the Fed. During this period, retirees have not been able to earn a meaningful yield on their cash and bond holdings, with the 10-year U.S. Treasury yield averaging only 2.5% since 2008. Today, investors can earn a yield of approximately 5.5% from Treasury Bills with maturities of six months or less. The time may be approaching for investors to consider forgoing higher short-term yields so that they can lock in marginally lower rates for longer maturities. Indeed, Treasury bonds with maturities of five to ten years carry yields ranging from 4.50% – 4.75%. By increasing the maturities on their bond holdings, investors can mitigate reinvestment risk, or the risk that short-term yields will be lower when their current short-term bonds mature.

While we expect higher yields to translate into higher returns for bonds over the coming years, they will likely serve as a headwind for equity returns. Typically, higher rates cause the valuations of equities to compress. This is because the discount rate, which serves as the denominator in the commonly used formula to value future corporate cash flows, is directly related to interest rates. Rising rates are particularly detrimental to growth stocks, or rapidly growing companies who derive a greater percentage of their value from future cash flows. Growth stocks have been the unquestioned market leaders for most of the past 15 years. Higher rates may finally bring about a leadership change that could benefit beleaguered segments of the stock markets such as small- and mid-caps, international equities, and value stocks.

Conclusion

Investors are recalibrating their outlook for the remainder of this year and next year. Many of them will likely recycle their 2023 forecast. Of course, a lot could transpire between now and year end to change their thinking.

For example, the risk of a geopolitical crisis remains acute. As we write this, Israel has declared war on Hamas, a Palestinian Islamic fundamentalist, militant, and nationalist organization, after a weekend of attacks. This is causing volatility in the energy markets. The ultimate impact from this conflict will not be known for some time.

Markets attempt to discount the future, which is inherently uncertain. This year should serve as a reminder of that. Uncertainty is why we obsess over our responsibilities to manage risk. One of the most reliable tools to mitigate risk is diversification. By owning investments that behave differently in a variety of environments, we ensure we are not leaning too far in the wrong direction.

Sources: BCA Research, CNN, and Alpine Macro.

Leave A Comment