Q4 2023 Colony Market Perspectives

The fourth quarter may be looked at as a pivotal moment for the Fed. Indeed, there was a noticeable and unexpected shift in Chairman Powell’s tone following the Fed’s December meeting, underscored by his comment suggesting that he and his colleagues are mindful of the risks of keeping interest rates high for too long. The accompanying Summary of Economic Projections showed that members are now forecasting three 0.25% rate cuts in 2024. Market participants interpreted this as the beginning of the end to the currently restrictive monetary policy regime.

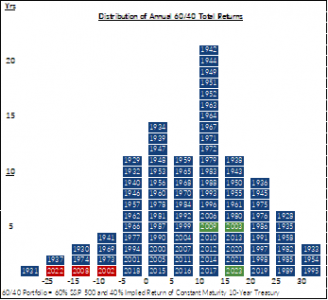

Most asset classes performed well in 2023 with a significant portion of gains accruing during the last two months of the year. U.S. equities were among the leaders once again, with the S&P 500 returning 11.7% for the quarter and 26.3% for the year. International equities reported generally strong returns too as the MSCI ACWI ex-USA index returned 9.8% and 15.6%, respectively, for the quarter and year. Emerging markets, particularly China, were a headwind for international equities’ performance.

The yield on the U.S. 10-year Treasury bond ended the year at 3.88%, exactly where it ended 2022, however the voyage was uneven. The Bloomberg Aggregate Bond Index looked as if it was going to end up with its third consecutive year of negative returns through the end of October, with yields on the 10-year Treasury up 1.10%. A furious rally during November and December pushed returns into positive territory for the quarter and year, with the index up 6.8% and 5.5%, respectively.

Despite widespread consternation in the beginning of the year, 2023 was a great year for investment markets. As investors shift their focus to the next twelve months, there is a feeling of optimism surrounding the results of the Fed’s efforts. Has Chaiman Powell and his mates successfully pulled off an elusive soft landing?

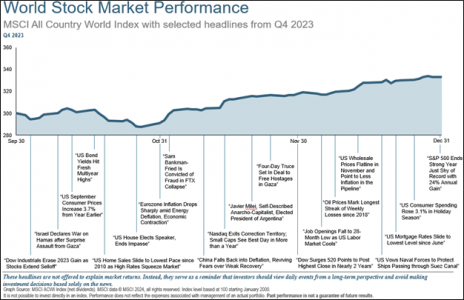

CHART 1: 2022 versus 2023

Running in Place

These past few years have served as a cautionary tale against chasing investment returns. With two strong years sandwiched around a difficult year, investors’ penchant to buy what’s been working likely lead to underperformance. Getting whipsawed by markets is a lesson most investors learn early and often in their careers.

For example, it is noteworthy that despite value outperforming growth in 2022, and growth retaking the leadership mantle in 2023, investors who were diversified equally across both outperformed for the two-year period. In summary, chasing growth’s outperformance into 2022 or chasing value into 2023 would have been costly.

The past two years were particularly challenging. 2022 and 2023 were essentially mirror images of each other (chart 1). 2022 experienced a bear market after the Fed began increasing interest rates in earnest to try to tame inflation. Interest rate hikes continued into 2023; however, investors were able to see through the tumult as inflation decelerated without much of a softening in economic growth. Stocks and other riskier assets rallied, recovering most of the previous year’s losses. In fact, the S&P 500 finished the year approximately 1% from its all-time high reached on January 3, 2022.

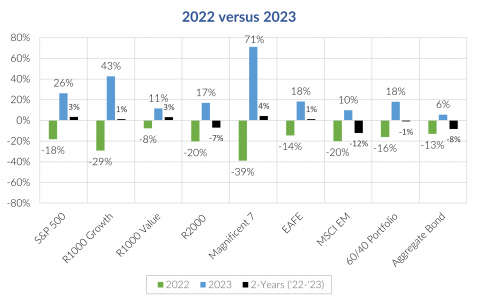

One of the unique elements of the 2022 investment markets was that bonds behaved differently from how they typically do during bear markets. Historically, bond prices would increase and yields decline during bear markets in anticipation of Fed interest rate cuts. In 2022, however, both stocks and bonds declined causing many to question the future of the quintessential balanced portfolio: the 60/40 portfolio (60% stocks and 40% bonds). The ineffectiveness of 60/40 did not extend into 2023 and, like so many other benchmarks, the decline in 2022 was nearly fully offset in 2023. Nevertheless, the continued efficacy of the balanced portfolio will only be properly tested across a full market cycle.

CHART 2: Distribution of Annual 60/40 Total Returns 60/40 Portoflio = 60% S&P 500 and 40% Implied Return of Constant Maturity 10-Year Treasury.

With all that has transpired over the past two years, you’d expect something more than flat returns. Investors experienced a range of emotions, starting with hope and optimism at the end of 2021 as expectations of a return to normal following the pandemic was upon us. Next came anxiety as the Fed embarked on its monetary policy tightening. As we began 2023, anxiety gave way to fear as consensus believed a recession was just around the corner. These feelings were exacerbated by the Fed’s strengthening resolve over defeating inflation no matter the cost, even as a peak in headline consumer price index (CPI) became apparent. In November and December of this year, however, Fed rhetoric shifted making it apparent that they and many of their peers across the globe were readying to declare victory over inflation and were preparing to cut rates in the not-so-distant future.

What this means? – Experienced investors know that investing is not easy. Returns reflect a dynamic combination of factors, many of which fall within three broad categories: growth, valuation, and sentiment. Analysts are required to analyze the past, present, and future direction of these factors, something that is quite difficult to discern consistently.

These past few years have been especially difficult. The macroenvironment that emanated from the pandemic was unlike anything this generation of investors have ever seen. Perhaps, as the global economy continues to normalize, the patterns and indicators we’ve relied upon in the past will come back to the forefront. Until then, investors should prepare for more of the sort of volatility experienced over the past few years. This argues against chasing after last year’s winners.

Inflation 2.0?

Chairman Powell and his colleagues were ridiculed back in 2021 for the use of the word transitory when speaking about inflation. At that time, inflation was accelerating due to a combination of factors, including strong demand from unprecedented fiscal spending, tight labor markets, a spike in energy prices caused by Russia’s invasion of Ukraine, and supply-chain disruptions arising from the pandemic. The Fed was not aggressive in confronting inflation initially based on the incorrect assumption that inflation would come down quickly once workers returned and capacity utilization normalized.

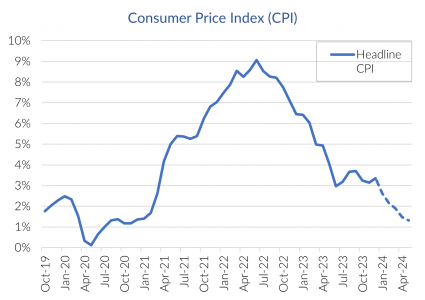

In hindsight the Fed and other central bankers were too complacent. By the summer of 2022, headline U.S. CPI reached almost 9%, more than four times the Fed’s target and the highest level since the early 1980s. Inflation across the G7 economies rose to 7.8% after averaging less than 2% the year before COVID.

Despite being slow on the uptake, policymakers ultimately followed through with a formidable series of rate increases. The Fed raised rates 11 times for a total of 5.25%, one of its most aggressive tightening campaigns in history. Policymakers in most other countries did the same with Japan and China being two notable exceptions.

More than three years later, inflation has come down quite a bit, but remains above most policymakers’ targets. November U.S. headline CPI was 3.1%, and economists are forecasting 2024 CPI of 2.6%. Employment and wages are cooling, oil prices and other commodities have fallen, and pricing surveys indicate that inflation is on the right trajectory. U.S. CPI may be even lower if not for quirks in the way the Bureau of Labor Statistics calculates the price of shelter. Most believe that the Fed now has the leeway to start cutting rates to levels that are neither restrictive nor accommodative.

CHART 3: Consumer Price Index (CPI)

What this means? – Despite the recent success in curtailing inflation, investors would be wise not to let their guard down. Policymakers would like to see an extended period of below average inflation to counteract the past three years.

Inflation is as much a state-of-mind as it is an economic phenomenon. If consumers start to believe that prices are primed to increase, it may become a self-fulfilling prophecy. Of course, supply and demand and fiscal and monetary policy have a large influence on prices.

Historically, inflation has come in waves. Strategas Research studied 62 unique inflation episodes across 24 countries where inflation peaked above 6.0%. Of those, 87% of the time, there were second or third waves of inflation after the initial peak.

There are reasons to believe that this period of inflation may be more likely to experience another wave. Indeed, the labor market remains unusually tight. The unemployment rate remains at a relatively low 3.7% and job openings outnumber people seeking jobs. Despite the Fed starting to raise interest rates nearly two years ago, we have yet to see a material impact on the labor market. Policymakers desire to safeguard their supply chains against rising geopolitical hostilities, often referred to as deglobalization, may also push prices higher. Moving manufacturing from locations with access to cheap labor may cause costs and prices to rise.

We do not believe the outlook for inflation is predetermined. There are both headwinds and tailwinds that policymakers will need to navigate. We will continue to dutifully pilot client portfolios across what may be rough seas.

Conclusion

Readers may be tired of hearing us talk about how unique the past few years have been for both the economy and investment markets. We do it to remind ourselves and clients that this time may be different. We are certainly mindful that this sentiment has been a pitfall for many over the past decades. Individuals have frequently used it to justify extremes in valuations, such as during the dot.com bubble.

Staying focused and nimble may be the best way to navigate what promises to be an interesting year. Monetary policy has reached an inflection point. Nearly 50% of the world’s population will elect new leaders in 2024, many of which have huge geopolitical implications. Finally, artificial intelligence holds the promise of being a momentous innovation with wide ranging impacts on productivity and employment. We remain steadfast in our commitment to safeguard our clients’ wealth while looking for prudent opportunities for growth.

Sources: Wall Street Journal, Strategas Research Partners, J.P. Morgan, Morningstar, National Bureau of Economic Research, and BCA Research.

Leave A Comment